Payday Loans for Short-Term Financial Solutions

Payday Loans for Short-Term Financial Solutions

Blog Article

Secure Your Future With Tailored Online Loans From Expert Financing Services

Tailored online financings used by expert car loan solutions have actually ended up being a popular option for individuals looking for economic support. How can you make sure that you are making the most of the possibility of your online finance to achieve lasting success? Allow's check out the crucial techniques and factors to consider that can help you make the most of your tailored on-line finance and set yourself up for a flourishing future.

Benefits of Tailored Online Loans

Tailored on the internet lendings use a myriad of benefits for individuals seeking customized economic remedies in today's digital age - Where to find a Payday Loan. One of the crucial advantages is the ease they offer. With on-line loan services, customers can request finances from the convenience of their office or homes, eliminating the need to visit physical branches. This ease of access likewise implies that individuals can request fundings any time of the day, making the process much more versatile and accommodating to diverse schedules.

Furthermore, tailored online lendings often feature quick approval processes. By leveraging electronic technology, lenders can quicken the confirmation and approval treatments, enabling customers to accessibility funds in a prompt manner. This quick turnaround time can be essential for people dealing with urgent unexpected expenditures or financial demands.

Exactly How to Select the Right Financing Solution

Offered the array of tailored online loan choices offered today, choosing the ideal finance solution that lines up with your certain monetary requirements requires careful factor to consider and educated decision-making. To start, recognize your monetary goals and the purpose of the lending. Understanding how much you need to obtain and of what particular reason will certainly aid narrow down the options readily available.

Following, compare rates of interest, charges, and repayment terms from numerous financing services. Seek clear loan providers who give clear info on their conditions. Take into consideration trustworthy financing solutions that have positive consumer evaluations and a history of trusted service. Additionally, examine the level of consumer support supplied by the funding service, as having accessibility to responsive help can be important throughout the loan procedure.

Furthermore, examine the flexibility of the funding solution in terms of payment alternatives and potential extensions. Make sure that the loan service straightens with your economic capabilities and supplies a settlement plan that fits your budget plan. By taking these variables into account, you can make a notified choice and pick the appropriate lending solution that finest fits your economic demands.

Understanding Car Loan Terms and Problems

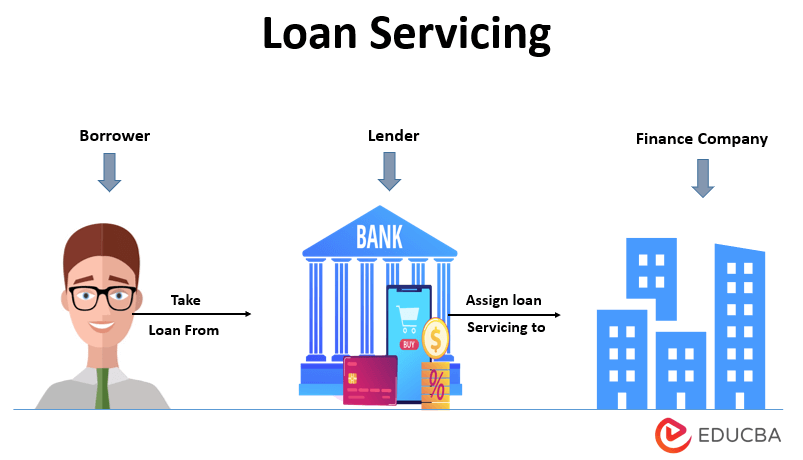

Recognizing the ins and outs of finance conditions is essential for customers looking for to make knowledgeable monetary choices. Financing terms and conditions outline the specifics of the agreement between the lender and the customer, including the car loan amount, rate of interest, payment routine, fees, and any other pertinent information. Where to find a Payday Loan. It is essential for borrowers to very carefully examine and comprehend these terms before agreeing to a lending to avoid any kind of shocks or mistakes down the line

One key facet of financing terms is the rate of interest, which identifies the cost of obtaining money. Borrowers need to pay close interest to whether the rates of interest is taken care of or variable, as this can impact other the total quantity paid back over the life of the loan. In addition, comprehending any costs related to the lending, such as source charges or prepayment fines, is crucial for budgeting and planning functions.

Steps to Safeguard Your Online Car Loan

Before continuing with securing an online finance, customers need to first guarantee they thoroughly comprehend the terms and problems detailed by the lending institution. When the terms are clear, the following action is to gather all needed documents. Lenders usually call for personal identification, proof of earnings, and banking info. It mortgage rates today is essential to have these papers conveniently offered to quicken the funding application procedure.

After collecting the called for paperwork, customers should look into various funding choices available to them. As soon as an appropriate car loan option is chosen, the application process can start.

Optimizing Your Loan for Future Success

To leverage the full potential of your lending for future success, tactical financial planning is important. Begin by describing clear goals for how the car loan will be utilized to move your financial endeavors onward. Whether it be buying more education and learning, broadening your business, or combining current financial obligations, a well-thought-out strategy is vital. Make best use of the effect of your funding by thinking about the long-term effects of your monetary decisions. Review the same day cash loans rates of interest, settlement terms, and prospective rois to ensure that the financing straightens with your goals. In addition, discover ways to optimize your spending plan to suit loan settlements without compromising your economic stability. By remaining organized and disciplined in your strategy to handling the loan, you can establish yourself up for future success. On a regular basis monitor your progression, make adjustments as required, and seek support from monetary advisors to make educated choices. With a tactical frame of mind and sensible financial administration, your loan can function as a tipping stone towards attaining your long-term goals.

Final Thought

In verdict, customized on-line lendings from expert finance solutions supply numerous benefits for securing your future financial stability. By thoroughly selecting the ideal finance solution, recognizing the conditions, and adhering to the essential actions to safeguard your loan, you can optimize its possibility for future success. It is very important to come close to on-line finances with care and make sure that you are making notified decisions to achieve your financial objectives.

Report this page